Your Bridge to Global Markets

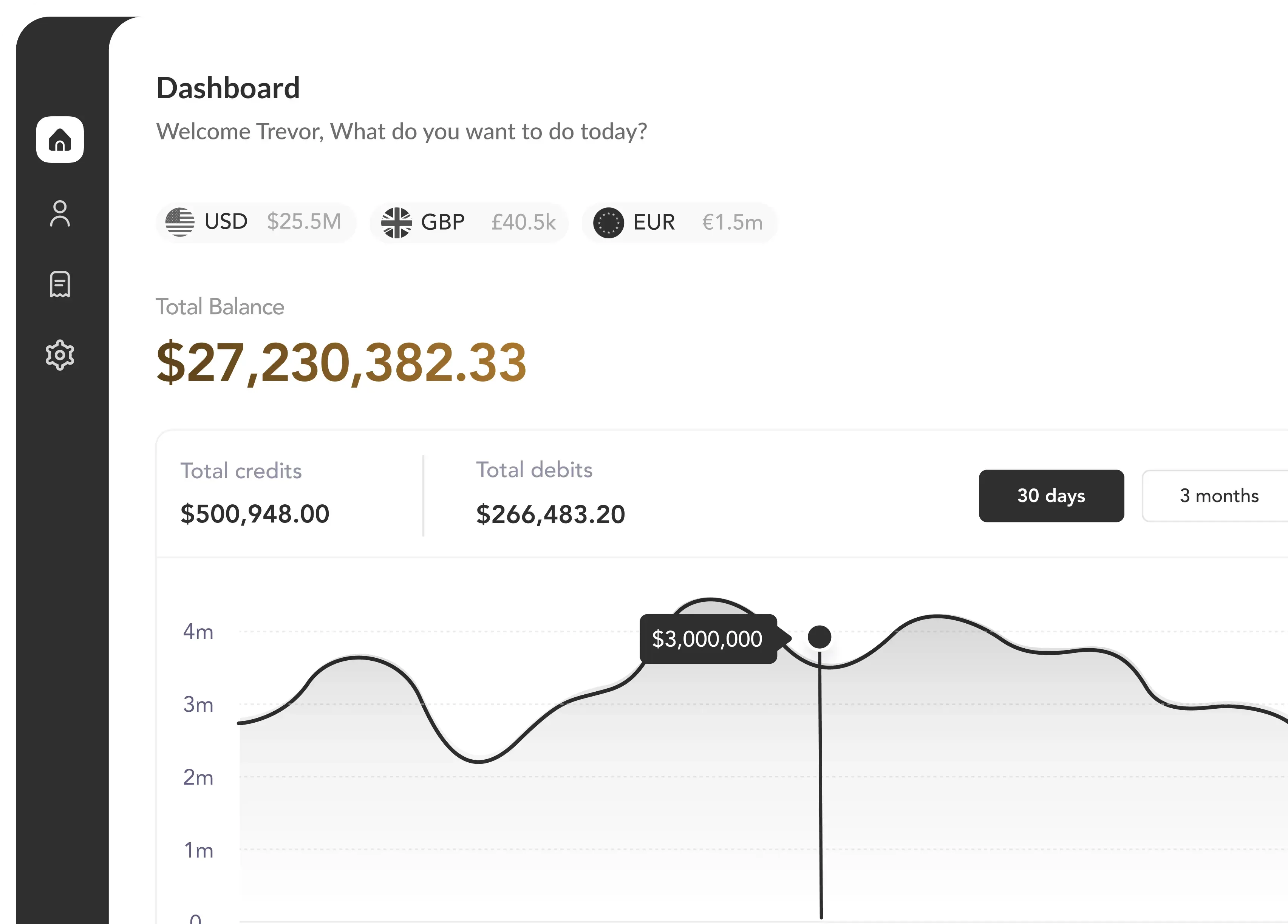

Open multi-currency accounts to receive money, make international payments, and enjoy competitive FX rates —all from your US-based business account.

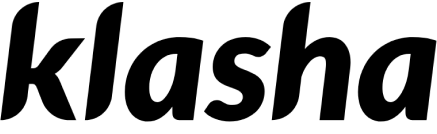

You’ll get fully-featured USD, EUR, GBP & *NGN accounts capable of Domestic Wire, ACH, SWIFT and other local payment methods

Trusted by innovative companies and partners

Global accounts & cross-border payments, crafted for your business

Get fully-featured USD, EUR, GBP and *NGN accounts for foreign exchange and international business payments.

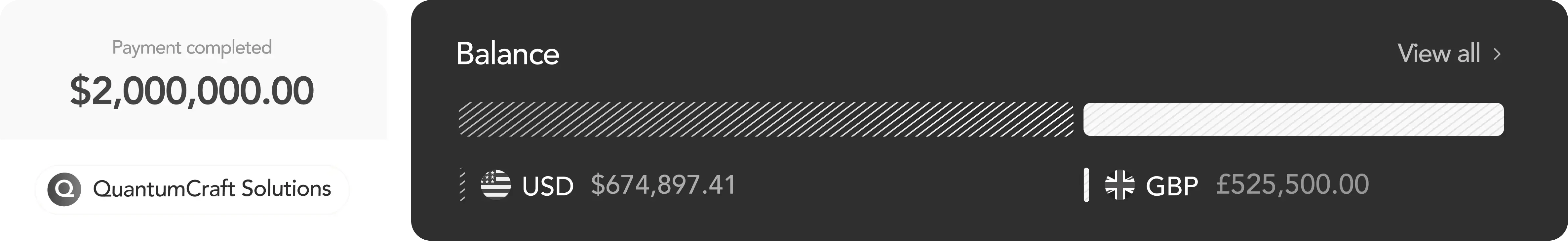

Receive and send third-party payments

Open and manage accounts in multiple currencies including USD, EUR, GBP, & NGN. Get access to local & global payment rails for receiving and making 3rd-party payments

Unlock more value for your business

Open a multi currency account on lync and get access to over $1M in discounts on the best SaaS software tools to grow your business.

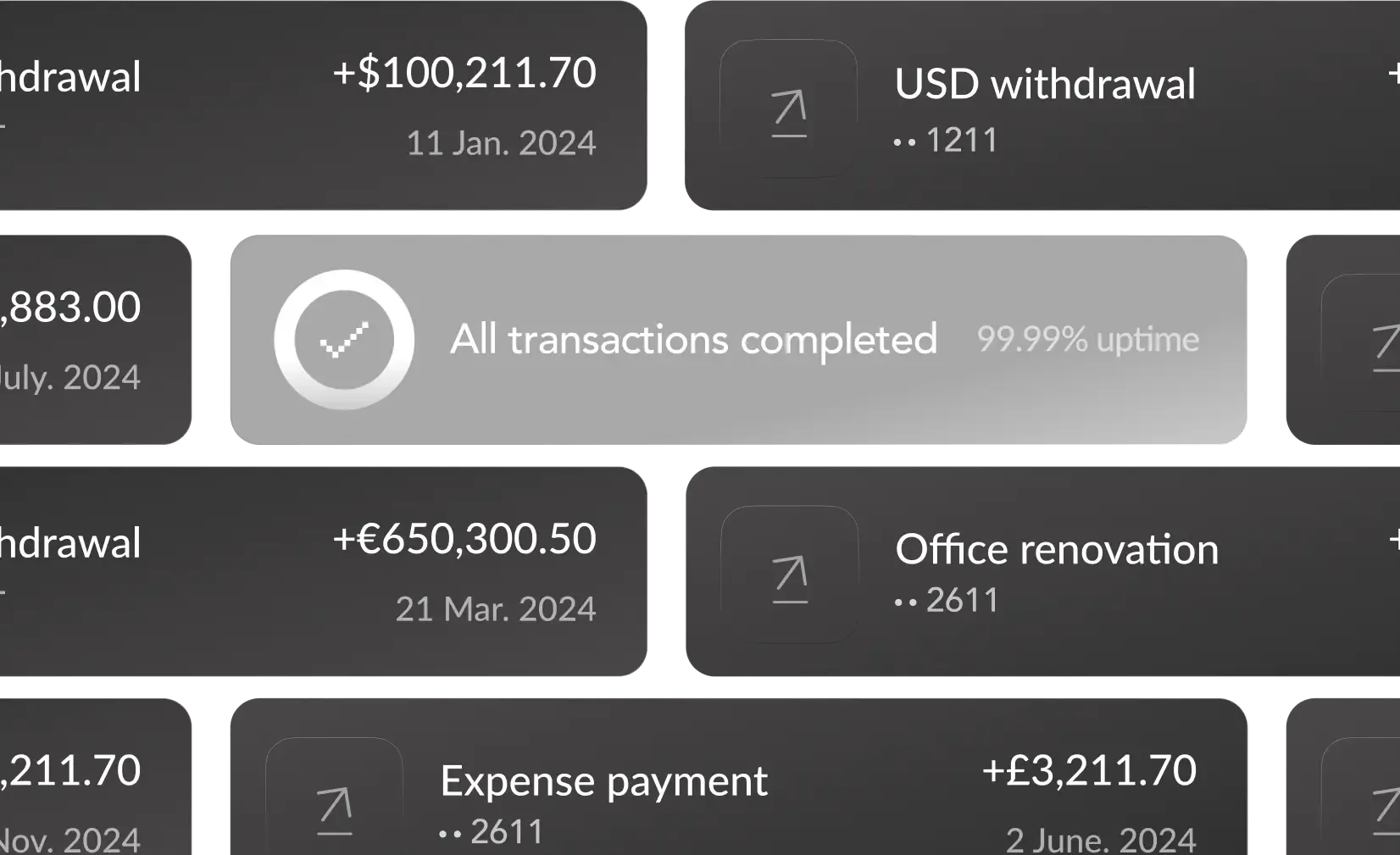

Receive, Exchange, and Pay globally

Easily receive payments, exchange between currencies, and make payments globally all within your Lync account

Why Lync?

Here’s what Lync can do for your business

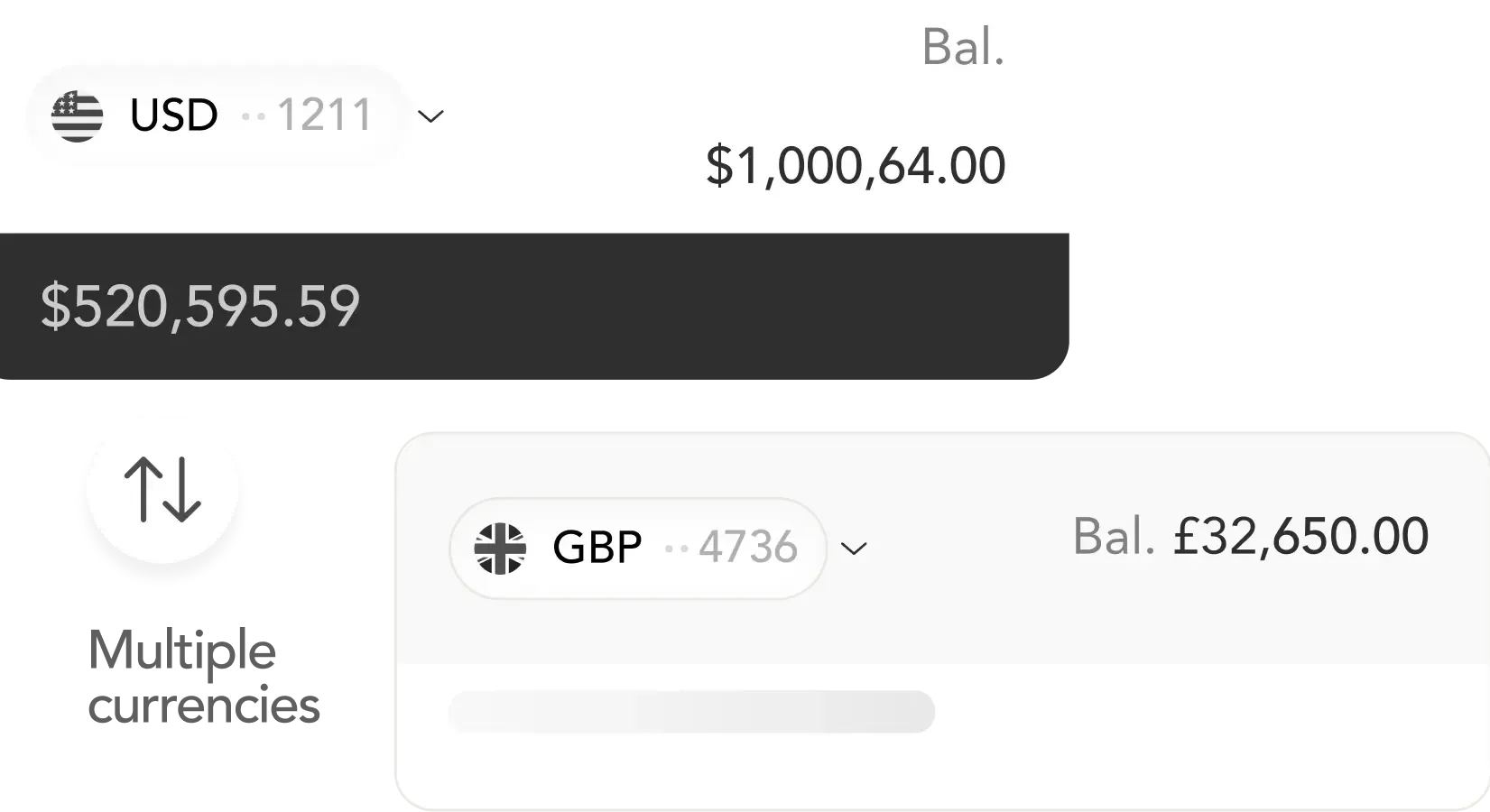

Multi-currency accounts

You can open a USD, EUR, GBP, or *NGN account capable of local & international 3rd party payments. These accounts are fully-featured, providing you with the best payment experience for your business.

Domestic & international wires

Utilise domestic wire, ACH, and SWIFT for your payments, all optimised to be completed within 24 hours, using local payment rails where available.

Competitive FX rates

We’re great at FX transactions! That’s where we started. We’ll offer you competitive, real-time exchange rates that’ll help minimise your costs.

24/7 Support

Your business doesn’t stop, neither do we. Our support team is available around the clock to ensure your queries and issues are resolved promptly.

Advanced security

Fintech security is paramount. That’s why we employ cutting-edge security measures to protect your financial data and transactions against threats.

Flexible service solutions

Understanding that every business's financial flow is unique, we offer flexible products & service offerings adapted to your specific use case.

Coming soon to Lync...

Extend Your Capabilities with Lync:

Build Financial Solutions

with Our Robust API

Start Building | Read the docs

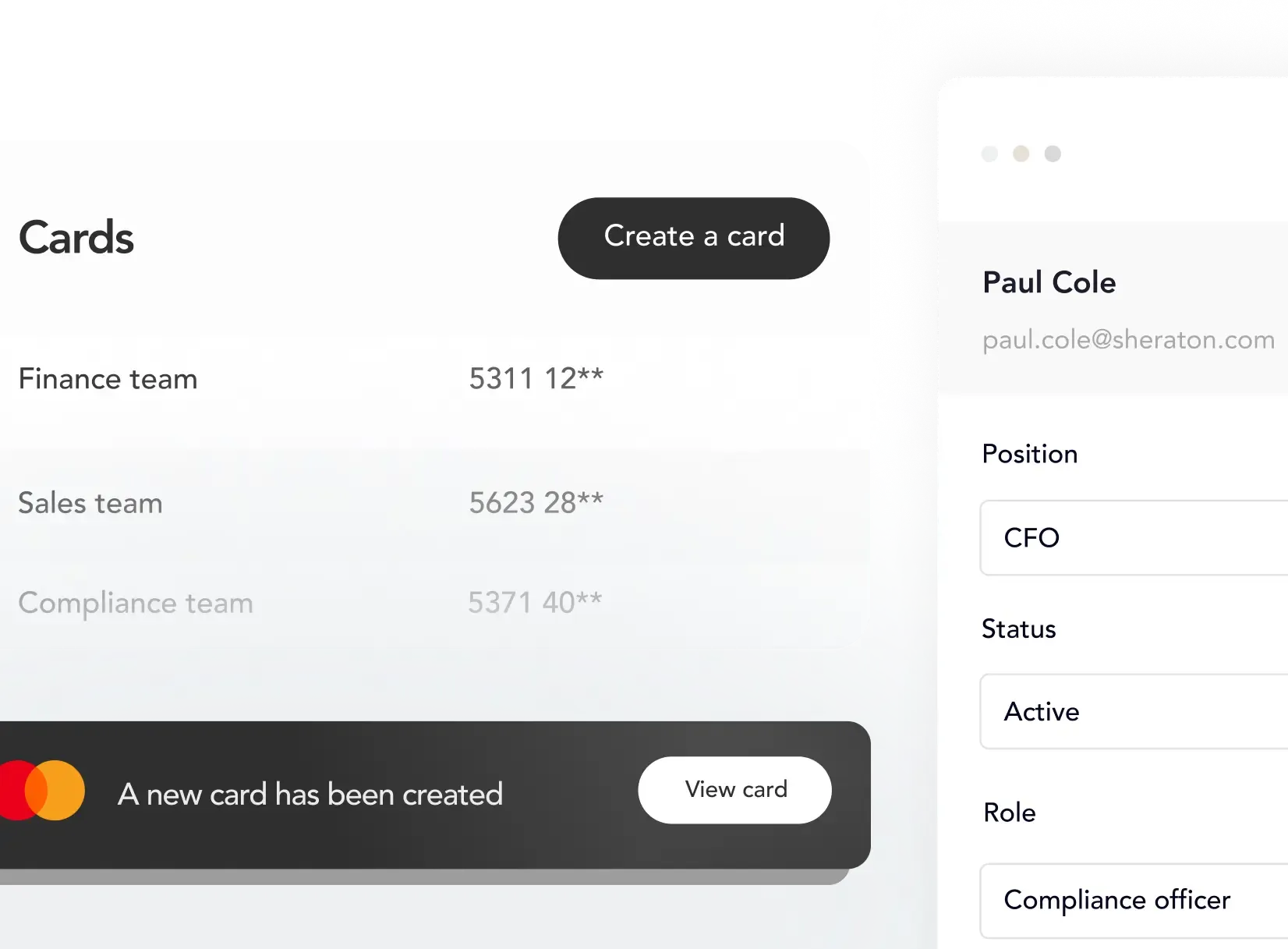

Corporate cards & spend management

Generate and manage corporate cards directly through our API. Equip your teams or customers with secure and customizable corporate cards, complete with spending controls and real-time tracking.

Bulk Payments

Streamline your payment processes by leveraging our Bulk Payments feature through our API. Enables the automation of mass payouts like payroll, vendor payments, or customer refunds, with just a single API call.

Multi-currency vIBANS & sub-accounts

Create and manage virtual IBANs for your customers, facilitating smoother and more organised international payments. You’ll be able to enhance your payment processes and reconciliation with these dedicated virtual accounts.

SECURITY

Transact with complete confidence

Our infrastructure safeguards your financial data with top-tier encryption and ongoing monitoring, providing you with a secure and reliable payment experience.

Strict security protocols

Our operations comply with the highest international standards, as evidenced by our ISO certifications. These certifications reflect our commitment to maintaining stringent security protocols, data privacy practices, and operational procedures.

*Real-time fraud monitoring

Our systems continuously scans for unusual activity, providing real-time fraud monitoring to prevent unauthorised transactions. This proactive security measure helps safeguard your accounts around the clock.

Advanced Encryption

We utilise advanced encryption technologies to secure all data transmissions between your devices and our servers. This means your sensitive financial information is always protected from unauthorised access and breaches.

FAQ

We know you have questions, we are here to provide answers.

How long does the onboarding process take?

Is there an onboarding fee?

What fees apply to payments?

Does Lync provide onboarding or training support?

- Creating and verifying your account.

- Setting up user roles and permissions.

- Navigating key features such as transactions, account management, and reporting tools.

What is the minimum trade size for FX conversions?

What are you waiting for?

Get your business account in minutes!

Whether you're a startup or an established enterprise, if your business is US-incorporated, you can open your account in just minutes and start transacting globally.

Create an account & submit your KYC

Go through compliance screening & due diligence checks

Get access to your multi-currency accounts